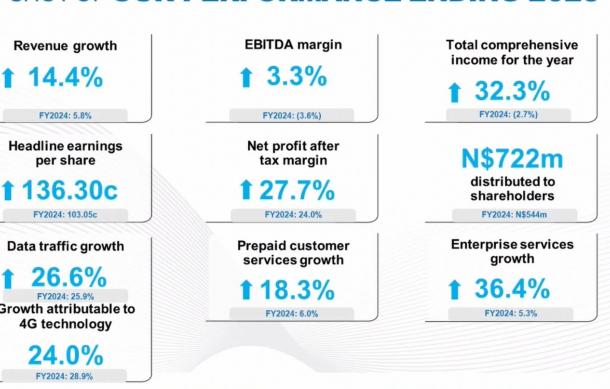

For the 2025 financial year, Mobile Telecommunications Limited - MTC recorded an impressive 14,4% increase in revenue, growing from N$ 3,2 billion in 2024 to N$ 3,7 billion this year.

This was revealed by Managing Director Dr. Licky Erastus during a presentation on the company's financial performance in Windhoek.

The company's profit for the year rose by 32,3% translating to N$ 1 billion compared to N$ 772 million in the previous year.

MTC Managing Director Dr. Licky Erastus had this to say.

“We remain the preferred telecommunication company in the country, and we say this because we are currently serving over 2,3 million active customers. Our network coverage remains the best, reaching over 98% of the population, of which 86,5% is covered with Long Term Evolution. During 2025, we also strengthened our growth structure with the activation of the MTC Maris, which is a key enabler for digital inclusion.”

Although, MTC's total expenses increased by 5,5%, that is N$ 2,34 billion, this was outweighed by stronger operational performance, with profit from operations jumping 33,1%, or N$ 1,36 billion.

MTC's Financial Director, Thinus Smit also highlighted that it was a good year for the company.

“From a cost point of view, we need to have control of the cost, and we reported earnings before interest, taxes, and amortization, an increase of 3.3% year-on-year.”

Enterprise services grew by 36,4%, while data traffic rose by 26,6%, driven largely by 4G expansion and the launch of 5G services in 2025.

“To highlight on the capital side for 2025, you will see in the numbers that we disclosed there was an increase in our capital investment, and we invested in fiber. So this is to make sure that we can do proper customer service and also a sustainable future.”

Beyond traditional telecom services, MTC is positioning itself for future growth through enterprise services, digital platforms and FinTech expansion.

“What is important is our FinTech that we launched and Maris. We encourage that people start signing up and using it because at the end of the day the benefit from it is cost-saving”.

From a shareholder perspective, the company distributed N$ 722 million in dividends.

This is significantly higher than the N$ 544 million paid out in 2024.